Our Approach

We offer comprehensive services for a variety of defined contribution plans, including 401(k) Plans, Employee Stock Ownership Plans (ESOPs), Profit Sharing or Stock Bonus Plans, 403(b) Plans, and Simplified Employee Pension Plans (SEPs)

Our approach is based on a business model supported by three core pillars: Simplicity, Focus and Balance.

1. Simplicity

We do the Work for You

- Evaluate your current retirement plan, a process that includes identifying places where you may be paying hidden and unnecessary fees

- Vendor benchmarking

- Maximize tax benefits

- Protect you and your company’s fiduciaries from unnecessary litigation

- Write a Request for Proposal (RFP) and analyze proposals to make sure you obtain the best solution

- Monitor your plan investments

- Educate and motivate your employees to participate

2. Focus

Results, Not Procedures

- Think of us as one of your employees — one who just doesn’t happen to have an office on site.

- Our expertise is in helping you get the results you want, and helping you understand the complex rules and regulations.

- We sit on your side of the negotiating table to find the best retirement plan solution for your company.

- Once your plan is implemented, we monitor it regularly to make sure it continues to meet your company’s goals over time.

- That leaves you free to focus on what you do best: running your business.

3. Balance

Minimize Costs, Maximize Value

- Like many business owners, you are likely concerned about plan costs.

- Often, we are able to uncover places where you are paying unnecessary expenses and use that money to reduce your plan’s future expenses and cover other plan fees.

- Our Retirement Plan Diagnostic is conducted at the outset of our relationship and then, on a regular basis, to determine if there are opportunities for cost savings or program enhancements. This allows us to identify strategies and elements that may have been overlooked or not kept current.

Our Process

Through our years of experience working with corporate retirement plans, we have acquired a broadbased knowledge of pricing and plan providers across multiple platforms.

This enables us to offer a comprehensive suite of services and allows us to guide you in making smart, objective decisions in a wide range of areas, including:

1. RETIREMENT PLAN DIAGNOSTIC

2. RETIREMENT PLAN DESIGN

3. FIDUCIARY SHIELD

4. RFP MANAGER

5. EDUCATION EXPERIENCE

6. WEALTHCARE MONITOR

Focused Solutions

This enables us to offer a comprehensive suite of services and allows us to guide you in making smart, objective decisions in a wide range of areas, including:

RECORDKEEPING

- Participant-level recordkeeping/accounting

- Employee and employer reports

- Tracking investment allocations/changes and contribution changes

TECHNOLOGY SERVICES

- Services that enhance plan efficiency, productivity, understanding and value

- State-of-the-art technology

- Web-based participant investment tools

- Web-based employer tools

EMPLOYEE COMMUNICATIONS

- Materials describing plan design and investing

- Enrollment kits

- Payroll stuffers, posters, memos

- Newsletters

COMPLIANCE

- Plan document

- Summary plan description

- Annual 5500 and pertinent schedules

- ERISA Plan audit (if applicable)

- Discrimination testing

INVESTMENT MANAGEMENT

- All available investment offerings including cash, income, hybrid and equity investments

- Open architecture

COST ANALYSIS

- Hard dollar fees (that are a specific amount) – paid by the employer or employees, including participant recordkeeping, compliance, loan administration, hardship and distribution fees

- Soft dollar fees (that are a specific percentage) – generally paid by employees for investment management expenses and to subsidize some or all of the administrative fees

Fiduciary Guidance

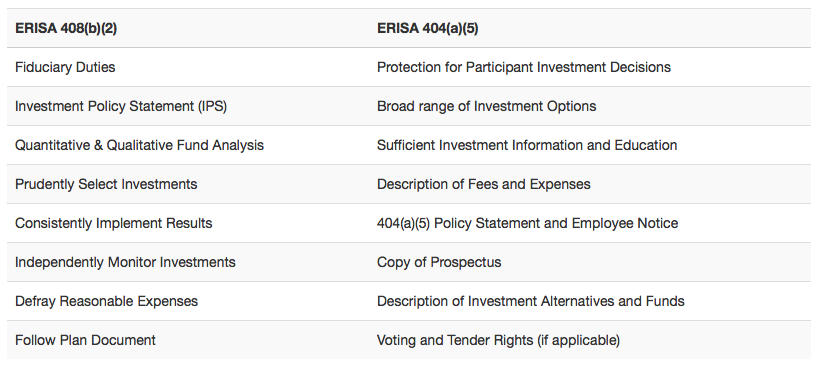

To help you comply with these and other ERISA rules, we provide fiduciary guidance and tools to help you reduce your exposure to fiduciary liability.

4605 East Galbraith Road, Suite 200

Cincinnati, OH 45236

(513) 898-9100

info@touchpointwealthpartners.com

Advisory Services offered through Valmark Advisers, Inc. a SEC Registered Investment Advisor. Securities offered Through Valmark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Suite 300 Akron, Ohio 44333-2431 1-800-765-5201 TouchPoint Wealth Partners is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.

Click here for Valmark Customer Relationship Summary.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.