Protecting Your Wealth (Life Assurance 360™)

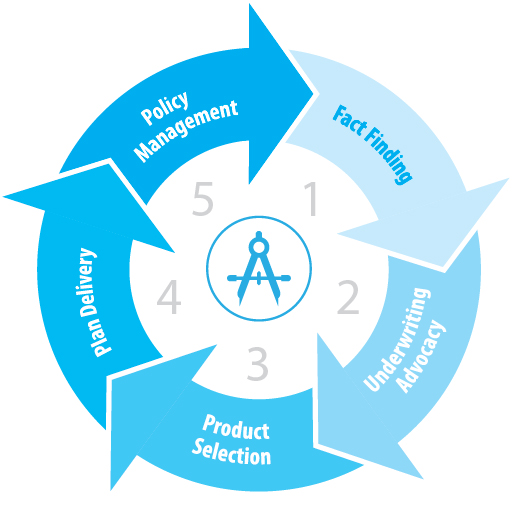

By taking a comprehensive, 360° approach to designing, implementing and managing life insurance, we believe that the outcome produced for our clients is better than when each of these steps is addressed in isolation…that the whole is indeed greater than the sum of its parts.

Concierge Services

These private insurance services are made possible by:

- Proven methodology and technology

- A dedicated team of experienced insurance operations specialists

- Strong relationships with the industry’s leading insurance carriers

- Over 50 years of experience providing private, sophisticated services to valued clients of Valmark insurance professionals.

Navigating Policy Pricing (Underwriting Advocacy)

Using our knowledge of how carrier underwriters, medical directors, and actuaries make decisions, we proactively position your life insurance application it its most favorable light.

CASE STUDY

Clarification of medical details results in a favorable rating

SITUATION: A couple in their early 70s needed $30 million of coverage for their estate plan. The husband was uninsurable due to multiple heart attacks. The wife was also considered uninsurable due to obesity with a history of multiple “mini-strokes”, high blood pressure, asthma, and sleep apnea.

APPROACH: After reviewing the case, the Underwriting Advocacy Team determined that the wife might be insurable. They worked extensively with the wife’s physician to demonstrate that the “mini-strokes” were, instead, migraines. They showed that the wife’s high blood pressure was well controlled, and the asthma and sleep apnea were mild.

RESULT: $30 million of coverage was issued at standard (vs. rated) rates.

CASE STUDY

A strategic approach to securing underwriting through multiple companies results in a more efficient insurance portfolio

SITUATION: A couple in their early 60s with a net worth in excess of $100 million needed $50 million of coverage at a more efficient price. They had $30 million of coverage in force.

APPROACH: Coordinating the applications for coverage with multiple companies was essential in this case. The Underwriting Advocacy Team first used a private inquiry process to secure initial offers from the companies. Secondly, they coordinated three applications in phases to avoid exceeding carrier capacity limits. Lastly, they arranged to have the clients examined only once for all three applications.

RESULT: $50 million of joint coverage at preferred rates which increased the overall efficiency of the couple’s insurance portfolio.

CASE STUDY

The addition of contextual medical information clarifies medical history and results in a favorable rating

SITUATION: A 60-year-old male diabetic needed $2 million of coverage. He had a history of burst vessel in his eye and also an abnormal amount of protein in his urine (an indication of a possible kidney problem).

APPROACH: The Underwriting Advocacy Team reviewed the client’s medical records and highlighted the client’s excellent history of diabetic control and normal urine findings. They also provided a detailed summary of the client’s medical records, which reduced the amount of assessment time required by the insurance company underwriters.

RESULT: A standard offer was received for the entire $2 million of coverage. The Underwriting Advocacy Team’s knowledge of which carriers viewed diabetics favorably as well as their ability to address the abnormal protein finding were critical in securing coverage at standard (vs. rated) rates.

1. GATHER AND CLARIFY MEDICAL INFORMATION

2. PRIVATE UNDERWRITING RATING EVALUATION (PURE™)

By proactively providing the home office underwriter with a clarified and coordinated presentation of your medical information, we remove as many surprises as possible and can usually help positively affect the evaluation of your risk.

3. INSURANCE COMPANY SELECTION

Each carrier has a limited amount of risk it is willing to accept on a particular life. One large case submitted inappropriately to too many carriers at once, can flood the market. This can essentially block you from gaining access to higher amounts of coverage.

4. SUBMISSION ADVOCACY

UNDERWRITING INTERVIEWS: During the home office underwriting evaluation process, we conduct phone conferences, as needed, between your physicians and carrier underwriters so that the proper information and positioning is provided to obtain the most favorable offers possible.

5. SELECTION OF OFFERS

6. EXPERT MANAGEMENT

Policy Management (Policy Management Company)

Enhancing your Insurance Experience by Bridging Expectations with Results

Through our relationship with the Valmark Companies, we have access to The Policy Management Company which provides policy monitoring and management services for our clients’ in-force life insurance policies.

This is accomplished through an effective combination of technology, a dedicated team of policy management experts, and a professional process developed from Valmark’s 50+ years of experience with sophisticated life insurance policies.

Together, they form a durable bridge connecting your expectations of promised policy benefits with actual results. Our goal is to give you the assurance of ongoing policy performance while creating what we believe is a superior insurance experience. Potential advantages to both policy holders and trustees include:

- Assurance of ongoing policy performance

- Access to all policy information in one centralized location

- Assurance that your insurance needs are always covered

- Automated trust administration and documented policy performance

- Assurance of ongoing service by a trusted third party

CASE STUDY

Guaranteed products need to be continually monitored and managed. The slightest deviation from the policy plan can cause a guarantee to go off track.

SITUATION: A 50-year-old entrepreneur purchased a $2 million Guaranteed Universal Life policy with an annual premium of $50,000 and a lifetime guarantee.

CHALLENGE: In Year 2, the premium was two weeks overdue and the entrepreneur received a termination notice from the carrier giving him the option to pay $50,000 and receive a one-year guarantee or pay $145,000 for a lifetime guarantee.

Upon investigation, the advisor learned that the late payment had automatically caused a rate change that would have cost the entrepreneur $95,000 to reinstate the lifetime guarantee

RESOLUTION: The Policy Management Company was called in and was able to leverage its relationship with the carrier to reinstate the lifetime guarantee without additional premium. Of note, had the policy been originally supervised by The Policy Management Company, this situation could have been avoided due to proactive services such as premium alerts and advance notices.

CASE STUDY

Over time, sustained low interest rates can significantly affect the performance and guarantees of many different types of insurance policies.

SITUATION:A recently-retired, 65-year-old corporate executive purchased a $3 million Universal Life policy for a single premium payment of $850,000. The original policy was projected to sustain the death benefit to age 100 based on the current interest rates.

The client, who is now 85 years old, was notified that his policy is projected to lapse at age 89 due to the sustained low interest rate environment.

CHALLENGE: The carrier gave the client the choice of paying an annual premium of $129,079 to extend coverage to age 95, or $173,338 per year to extend coverage to age 100.

TAKE AWAY: This particular product design has the greatest risk of lapsing early due to the current low interest rate environment. If the policy would have been monitored more closely over the years, early intervention could have significantly reduced the amount of premium required to maintain coverage until age 100.

Life Settlements

4605 East Galbraith Road, Suite 200

Cincinnati, OH 45236

(513) 898-9100

info@touchpointwealthpartners.com

Advisory Services offered through Valmark Advisers, Inc. a SEC Registered Investment Advisor. Securities offered Through Valmark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Suite 300 Akron, Ohio 44333-2431 1-800-765-5201 TouchPoint Wealth Partners is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.

Click here for Valmark Customer Relationship Summary.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.